Life Insurance in and around Terre Haute

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Terre Haute

- West Terre Haute

- Brazil

- Staunton

- Clinton

- Sullivan

- Farmersburg

- Greencastle

- Cloverdale

It's Never Too Soon For Life Insurance

When you're young and a recent college graduate, you may think you should wait until you're older to get Life insurance. But it's a good time to start thinking about Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Agent Mark Huffman, At Your Service

Life can be just as uncertain when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers multiple coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific time frame, State Farm can help you choose the right policy for you.

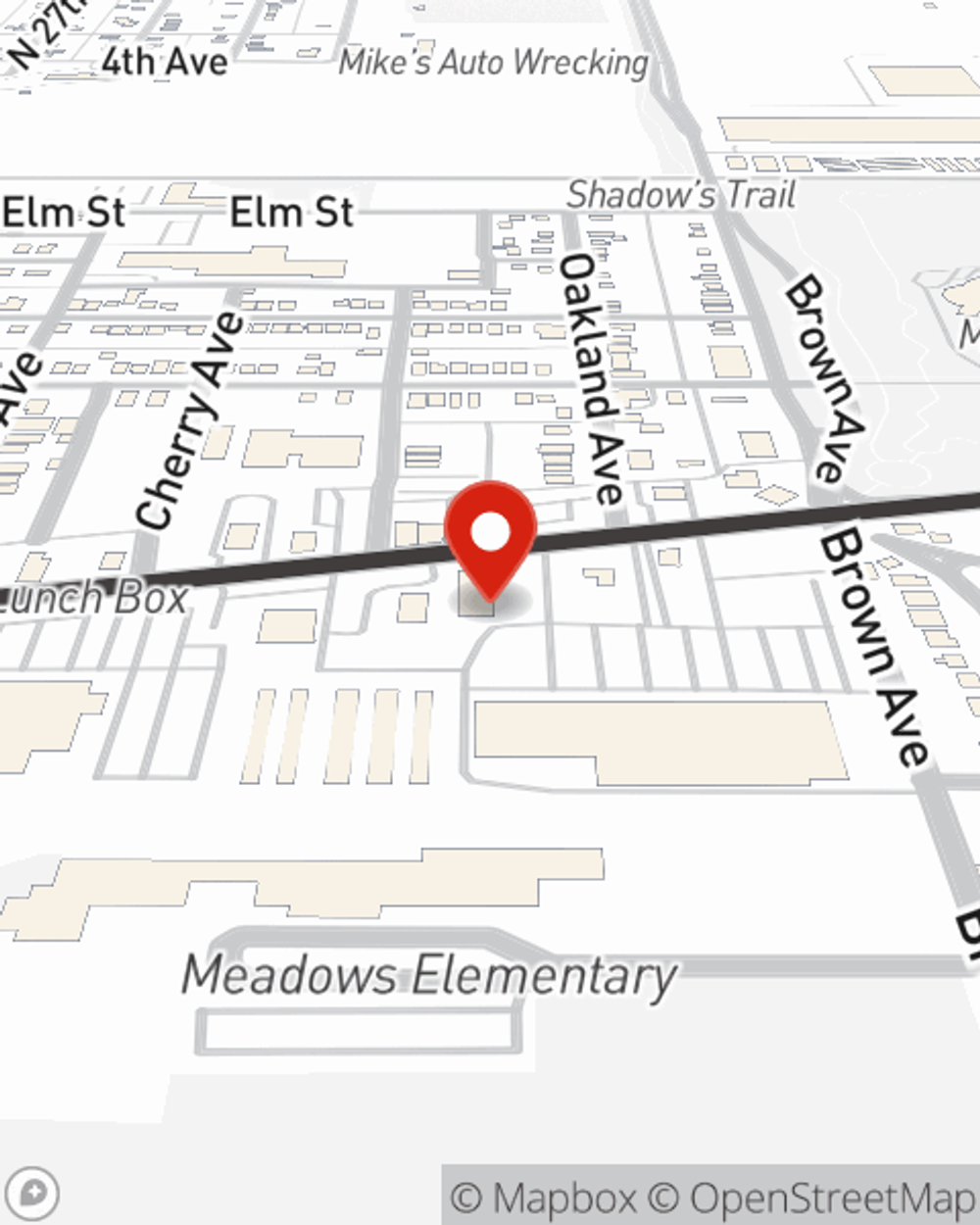

As a trustworthy provider of life insurance in Terre Haute, IN, State Farm is ready to protect those you love most. Call State Farm agent Mark Huffman today and see how you can save.

Have More Questions About Life Insurance?

Call Mark at (812) 234-0705 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Mark Huffman

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.